Quickbooks is an accounting app that brings in positive improvement over time. This is why most small and medium-sized firms choose Quickbooks to other accounting applications. Quickbooks’ road to growth is unavoidable due to the continuous influx of patches and new features. Unfortunately, Quickbooks consumers like you and me have to deal with problems every now and then. One of the problems is the negative inventory question in Quickbooks. It is not a software glitch or flaw, unlike other mistakes and problems (QB error 179, error 6144 82, error 1334, error 6210, and so on). This is mostly when the customer joins the sales transaction before the buying transaction.

Anyway, you don’t have to get worked up over this. This is because we are here to assist you. This article will teach you what you need to know about Quickbook negative inventory. Also the solutions to this issue. So, without further ado, let’s get started.

What exactly is a Negative Inventory?

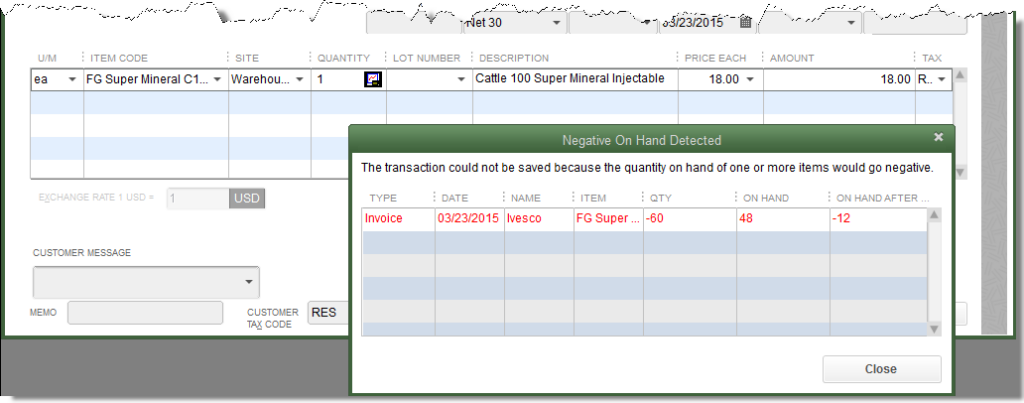

The Quickbooks online inventory problem is mostly triggered when the customer enters sales transactions before entering purchasing transactions. This indicates that you have sold inventory pieces that are no longer in stock. This could seem to be a minor blunder, but it may lead to a cascade of problems. Let’s take a look at what they are.

- Data loss forces you to constantly rebuild the file in order to get your B/S back into balance.

- The cash-basis record is unbalanced.

- The profit and cost of goods sold (COGS) amounts are false.

- The square measure on the Balance Sheet Inventory Account is erroneous.

- Merchandiser reports that are incorrect.

- Error code: LVL ERROR—

- Verify Account Error: The balance is invalid. There has been an amount of overflow. Ninety-nine is the new record.

- Error: Account Balance Verification Failed. Calculate bal = 0.00, List bal = *overflow* An overflow error has occurred. Each of the accounts has met the maximum allowable value. Examine the balances of the chart of accounts and reduce the account’s value to no more than ten,000,000,000,000.

How can I determine the existence of a Negative Inventory?

The IVD is the only documentation you can need to determine the magnitude of your detrimental inventory. The Negative inventory displays negative numbers in the column titled “Amount Available” (QOH).

- Navigate to the Reports menu.

- Choose Inventory, then Inventory Valuation.

You should use the Negative Item Listing report whether you’re using QuickBooks Enterprise 15.0 or older. It is worth noting that it only displays present negative quantities and not previous negative quantities.

- Navigate to the Reports menu.

- Choose Inventory, then Negative Item Listing.

- Whether you’re not using QuickBooks Premier or Enterprise 2014 or earlier,

- Navigate to the Suppliers menu.

- Choose Inventory Activities, then Inventory Centre.

- Change the filter from Active Inventory to QOH = Zero at the top left of the Inventory Centre slot.

What are the potential issues?

- You made a brand new item with an Item price but no original QOH/VOH.

- This leaves the object with a price that is lower than the median.

- The item’s first community action was an invoice rather than a bill, scan, MasterCard price, or limit Qty/Value available (IAD).

- The object is now in negative inventory as a result of the deal.

- Although not a median price for credit inventory and debit COGS, the invoice takes the Item price from the Item List.

- You buy the item at a price that is not the same as the Item price.

- The bill includes a change to Inventory and COGS for the difference between the Item price and therefore the real sales price, causing it to appear on the P&L ledger.

- Selling inventory that you don’t have has reduced the available inventory (QOH) which could have resulted in an erroneous cost of goods sold (COGS) on the P&L report.

- You create a new item by not charging an item price.

- You sell the item without purchasing any inventory.

- QuickBooks does not have enough information from that to quantify the common price, so it could assign a median price of $0.00.

ALSO VISIT: QuickBooks Error 12029

How Can You Resolve Negative Inventory in QuickBooks?

If your inventory results square measure wrong and you haven’t identified a median value, you’ll allow them to reflect the right values by assuring that the earliest dated dealings with the associate item may be a fee, search, MasterCard payment, or change Qty/Value on Hand.

- Select Inventory from the QuickBooks Reports menu, then Inventory Valuation Overview.

- By double-clicking the object name, you can QuickZoom identify an item that is displaying incorrect values. This displays the item’s Inventory Valuation Detail report. The transactions pertaining to this item square measure are organized by year.

- To open the Enter Bills pane, QuickZoom the primary Bill mentioned.

- Change the bill’s date to the day before the primary invoice listed on the information sheet you opened in Step 2.

- Click Save and you’re on the verge of recording the bill for the new date.

- Steps two through five must be repeated for each incorrect piece.

Leave a Reply